Deloitte Webinar – Investor Update Series: Malaysia Transfer Pricing amendments

Deloitte Webinar – Investor Update Series: Malaysia Transfer Pricing amendments

The Finance Act 2020 has introduced some major changes to the transfer pricing regime in Malaysia, effective 1 Jan 2021. These changes would have implications for all open years of assessment. The amendments entail, among other things:

1. Tightening compliance requirements around contemporaneous and quality TP documentation through the introduction of stringent penalties;

2. Introduction of a surcharge that would be imposed on the transfer pricing adjustment imputed by the IRB and would also impact companies having tax attributes such as unabsorbed CA, business losses, incentives, etc.

3. Fortified power of the IRB to re-characterise transactions which will increase scrutiny by the IRB towards aggressive tax planning structures, disregard interest-free loans, re-characterise loan into equity, etc.

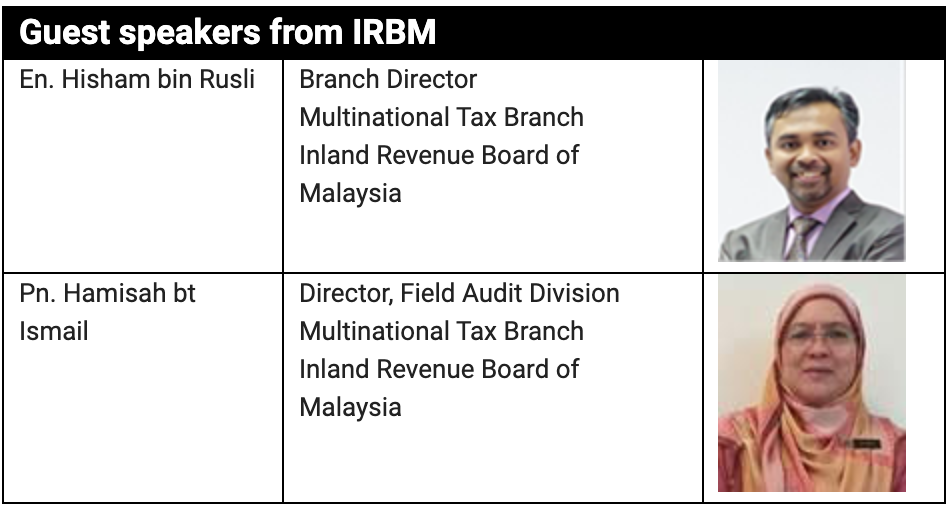

Join in the conversation as Deloitte transfer pricing practitioners and the Director of the Multinational Tax Branch of the Inland Revenue Board of Malaysia (“IRBM”) share their perspectives on the transfer pricing proposals in the Finance Bill 2020 and current trends.

Date: 18 march 2021

Time: 10.00 a.m. – 11.30 a.m.

Speakers